In the world of finance and investment, understanding the Debt Service Coverage Ratio (DSCR) is essential for any businesses and lenders alike. Whenever I go for investment in any company i always check first DSCR of that company. This ratio serves as a critical indicator of an entity’s ability to meet its debt obligations. I’m going to throw some light on what DSCR is, how to calculate it, its significance, and what constitutes a good DSCR.

Table of Contents

What is Debt Service Coverage Ratio?

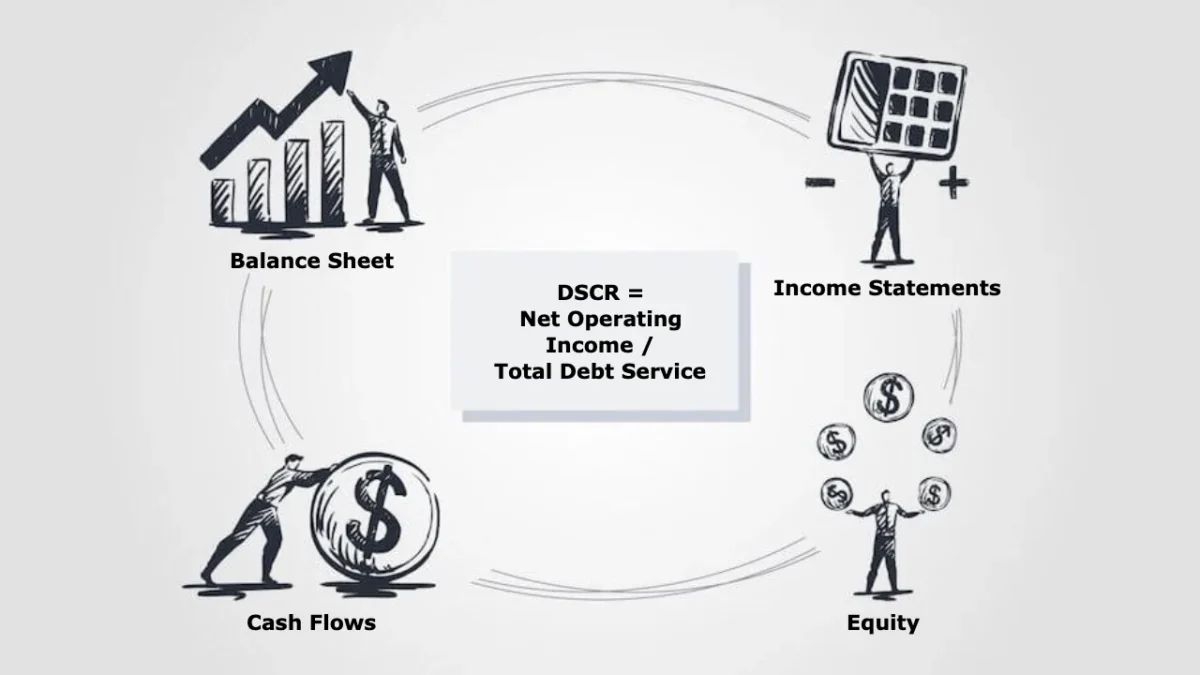

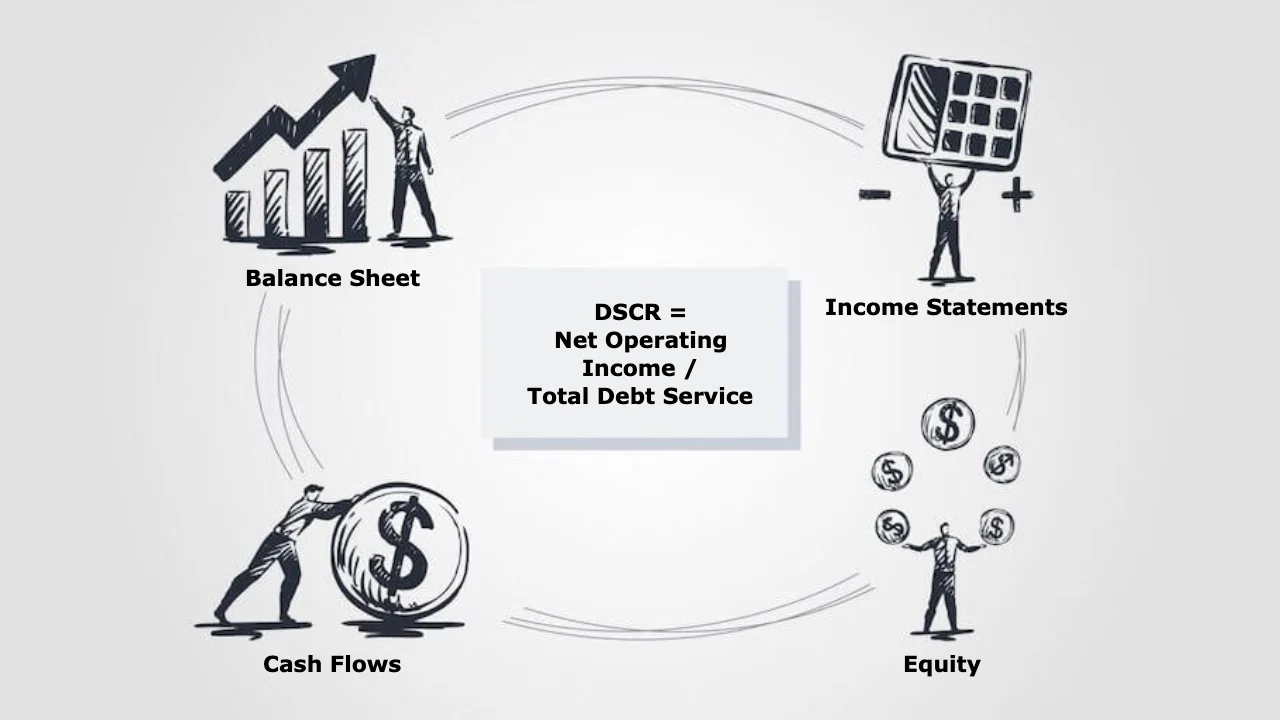

Debt Service Coverage Ratio, also known as DSCR, is a financial metric that evaluates an entity’s ability to repay its debt. It measures the cash flow available to cover the principal and interest payments on outstanding debt. Essentially, DSCR indicates whether an individual or a company has sufficient income to meet its debt obligations.

How to Calculate Debt Service Coverage Ratio?

To calculate DSCR, you divide the entity’s net operating income (NOI) by its total debt service. The formula is as follows;

| Title | Formula |

|---|---|

| DSCR | = Net Operating Income / Total Debt Service |

Let’s consider a hypothetical company, XYZ Corporation, which generates an annual net operating income (NOI) of $500,000 and has total debt service (principal and interest payments) of $400,000. To calculate the Debt Service Coverage Ratio (DSCR) for XYZ Corporation:

DSCR = Net Operating Income / Total Debt Service

DSCR = $500,000 / $400,000

DSCR = 1.25

In this example, XYZ Corporation has a DSCR of 1.25, which indicates that the company’s net operating income is 1.25 times its debt service. This suggests that XYZ Corporation has sufficient cash flow to comfortably cover its debt obligations.

How to Use Debt Service Coverage Ratio?

DSCR is commonly used by lenders and investors to assess the creditworthiness and financial health of individuals or businesses. A higher DSCR indicates a greater ability to service debt, which is generally viewed as a positive sign. Lenders often require a specific minimum DSCR before extending credit or approving loans.

What is a Good DSCR

The ideal DSCR value varies depending on the industry, risk tolerance, and specific circumstances. Generally, a DSCR of 1.2 or higher is considered favorable. This means that the entity’s cash flow is 1.2 times its debt obligations, providing a margin of safety and demonstrating the ability to comfortably meet its debt payments.

What is a 1.2 Debt Service Coverage Ratio?

A DSCR of 1.2 implies that the entity’s cash flow is 1.2 times its debt obligations. In other words, it has 20% more income than necessary to cover its debt payments. This additional cushion provides reassurance to lenders and investors, indicating a relatively low risk of default.

Conclusion:

Understanding and monitoring your Debt Service Coverage Ratio is crucial for maintaining financial stability and managing your debt effectively. Whether you are an individual seeking a loan or a business owner looking to attract investors, a healthy DSCR is a favorable indicator. By calculating your DSCR and aiming for a ratio above 1.2, you can demonstrate your ability to meet debt obligations and enhance your financial standing. Remember, maintaining a good DSCR not only increases your chances of obtaining credit but also contributes to your long-term financial well-being.

FAQs

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a financial metric that measures an entity’s ability to repay its debt.

How is the Debt Service Coverage Ratio (DSCR) calculated?

The DSCR is calculated by dividing the net operating income (NOI) by the total debt service.

What is considered a good Debt Service Coverage Ratio (DSCR)?

A DSCR of 1.2 or higher is generally considered favorable, indicating the entity has a comfortable margin of safety to meet its debt obligations.

[…] Debt Service Coverage Ratio | Meaning, How to Calculate, Significance […]